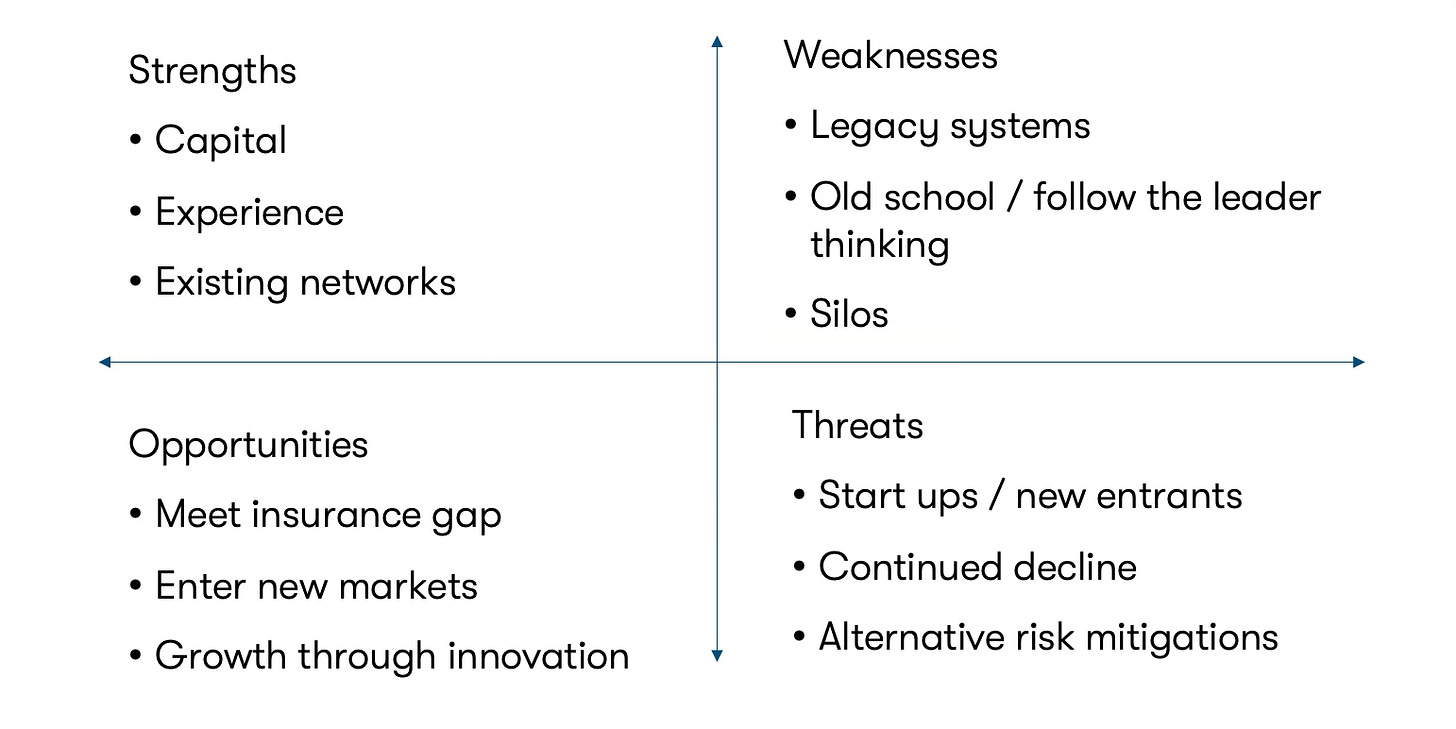

SWOT from SOA ImpACT

SWOT Analysis on Industry Challenges and Opportunities developed at the SOA ImpACT Conference.

At the SOA ImpACT conference last week, Richard Pyper and I delivered a session on the evolving landscape of insurance distribution. This session included a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis, offering a high-level overview of the industry. The interactive format of the session allowed us to refine our initial analysis, leading to the insights we are now sharing. Below is a more refined breakdown of the key takeaways:

Strengths

The insurance industry is inherently capital-intensive, meaning that incumbents with access to substantial capital are well-positioned to innovate. The combination of financial resources and the wealth of experience accumulated by these established players provides a significant edge. Additionally, these organizations are not starting from scratch. The value of established networks cannot be overstated: access to vast distribution channels and trusted relationships with customers offers an unparalleled competitive advantage.

Opportunities

A major shift in the individual life insurance sector has been observed over the past few decades. The number of life insurance policies sold has declined by approximately 30% over the last 30 years, presenting a clear opportunity to tap into underserved or overlooked markets. Furthermore, there are numerous niche segments that remain under-addressed. One key opportunity lies in addressing the "insurance gap"—the difference between the protection people need and what they actually have. Tools like RiskDX, which are designed to tackle these gaps, could be transformative in bridging that divide.

Weaknesses

The insurance industry is undeniably hindered by legacy systems. We've all witnessed projects falter due to the challenge of integrating or modernizing outdated infrastructure. However, it’s not just the systems themselves that pose barriers. Perhaps more insidious is the "old school" mentality that often accompanies these systems—thinking that resists change, progress, or even the adoption of new methodologies. This stagnant mindset can be especially problematic when coupled with organizational silos. In many companies, innovation is compartmentalized within individual departments, creating inefficiencies and limiting the ability to think and act holistically.

Threats

Start-ups are often seen as the greatest external threat to traditional insurers. Start-ups are unburdened by legacy systems and outdated business models, and their ability to think outside the box, adopt cutting-edge technologies, and operate with a sense of urgency and flexibility gives them a competitive edge. Additionally, there’s the continued decline of the industry as an overall threat, stemming from the failure to recruit new talent and address the evolving needs of the market. Finally, an important point raised during the discussion was the impact of alternative risk mitigation methods. Could disruptions that have affected other industries—such as the rise of ride-sharing apps in the taxi business—also impact insurance? By the time the taxi industry recognized the threat, the disruption had already been well underway, largely driven by the launch of the iPhone app store.

Conclusion

I wanted to share this updated SWOT analysis because the session was both fun and thought-provoking. Even as a presenter, I came away with new insights and ideas, underscoring the value of interactive discussions in driving innovation and fresh perspectives.