In my last post Omni-channel vs. Multi-channel, I stated that the “key to going digital is NOT blowing up your existing business model.”

This article from McKinsey covers How insurance can prepare for the next distribution model. Starting on the right foot with your customers and agents is critical, here are a few steps and how we have addressed them.

1. Getting Started

“The hardest part of getting started, is getting started”

Guy Kawasaki

Implementing a digital strategy requires starting small, but definitely with an omni-channel strategy. It is crucial to protect your reputation with your existing distribution.

Don’t cut corners with a minimum viable product (MVP) that is too constrained. Analytics are an example of a feature I have seen deferred too often, that’s why we have it pre-built.

In the past, insurance companies had to assume the full cost and risks associated with technology projects, but this is no longer the case. Our subscription model allows you to start with minimal investment and IT integration on a cloud hosted solution, that’s with your brand and products, and the process that suits your market.

2. Learn

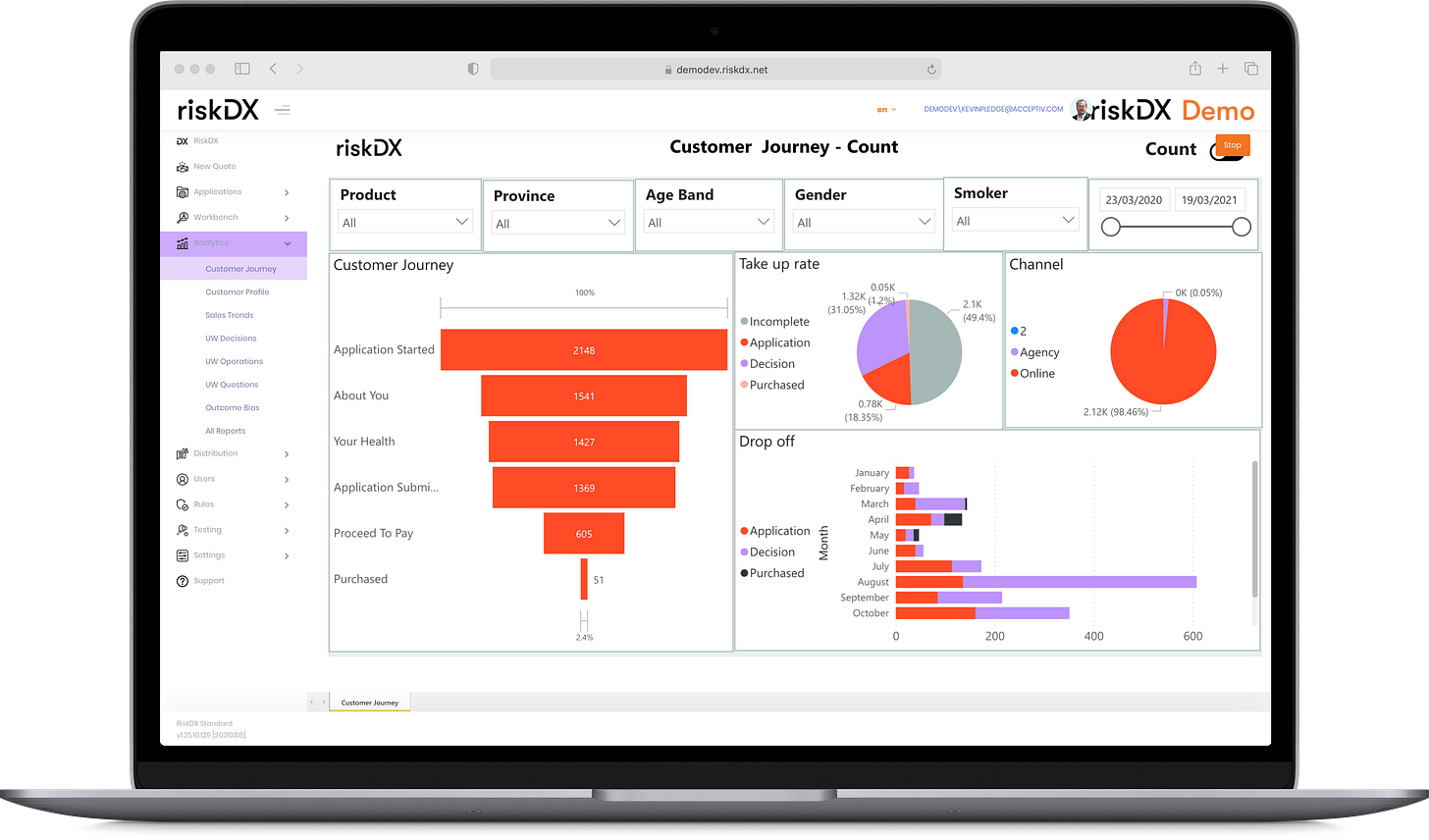

The ability to capture the right data and analyze results from day one is essential; this allows you to adjust and fine tune your strategy as needed.

This typically means looking at your experience from multiple perspectives, each of the five perspectives shown below has a different granularity of data and require separate analysis:

Customer Journey - what is your drop off rate? Where and why does this occur? What is the outcome of the underwriting decision at the application level?

Underwriting Questions - how are the questions answered? Which reflexive questions paths are being presented? Are they clear? Can they be improved?

Impairments - what impairments are you seeing? Are you seeing more or less heart conditions than you would expect?

Risk Decisions - what are the outcomes for individual risks or coverage? How are they made - auto or manual?

Manual Underwriting - what business required manual assessment? What is the workload of the underwriters?

3. Adjust

The ability to run A/B tests and continuously adjust your process based on what you learn is critical. This should be tested during the initial MVP evaluation; an early indication is that if it takes several months to set up the platform, it isn’t flexible enough.

Conclusion

The key to a successful digital transformation lies in a thoughtful and well-executed approach that prioritizes the customer experience while maintaining and enhancing the existing business model.

This post is about the importance of starting with a clear objective focused on the customer, learning from data and analytics, and continuously adjusting the process based on the insights gained.

To succeed in this digital age, insurers must remain agile and adaptable, leveraging data-driven insights to refine their strategies and optimize the customer journey. By focusing on these critical aspects, insurance companies can prepare themselves for the next era in distribution and secure a strong foothold in an increasingly competitive landscape.